social security tax rate 2021

If tax was withheld at more than one rate during the year the percentage shown. West Virginia passed a law in 2019 to begin phasing out taxes on Social Security for those with incomes not exceeding 50000 single.

Here S What Happens To Social Security Payments When You Die

Social Security functions much like a flat tax.

. If you have a combined income but are filing as an individual your benefits arent taxed if your benefits are below 25000. 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. However if youre married and file separately youll likely have to pay taxes on your Social Security income.

If your income is above that but is below 34000 up to half of. Its Estimated About 56 of Social Security Recipients Owe Income Taxes on Benefits. IRS Tax Tip 2021-66 May 12 2021.

12 hours agoIn Case You Missed It. More than 44000 up to 85 percent of your benefits may be taxable. The portion of your benefits subject to taxation varies with income level.

The largest social security tax increase was in 2021 but 2022 is high as well. For 2011 and 2012 the OASDI tax rate is reduced by 2 percentage points for employees and for self-employed workers resulting in a 42 percent effective tax rate for employees and a 104. The rate consists of two parts.

Thus the most an individual employee can pay this year is 9114 Most workers. Jane also received 5000 in social security benefits in 2021 so her total benefits in 2021 were 11000. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employees share of Social Security taxes.

This week at CBPP we focused on new Census data on poverty income and health coverage in 2021 health food assistance Social Security state. For both 2021 and 2022 the Social Security tax rate for employees and employers is 62 of employee compensation for a total of 124. As a result the Trustees project that the ratio of 27 workers paying.

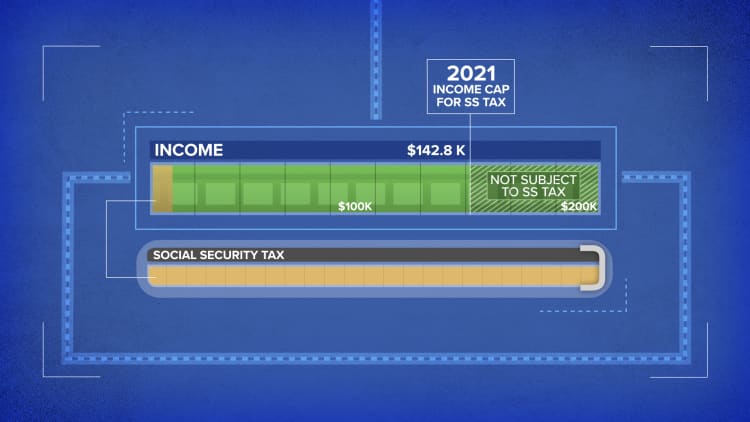

Security which means they are not subject to Social Security taxes nor do they count toward a persons future Social Security benefits. Everyone pays the same rate regardless of how much they earn until they hit the ceiling. Between 32000 and 44000 you may have to pay income tax on up to 50 percent of your benefits.

IRS Tax Tip 2022-22 February 9. Youll be taxed on. The self-employment tax rate is 153.

As of 2021 a single rate of 124. 62 of each employees first. During 2021 according to Table R-1 in the BLS Consumer Expenditure Survey American consumer units spent an average of 1549528 on food clothing and health care.

May 26 2021. In 2022 the Social Security tax rate is 62 for the employer and 62 for the employee. Up to 50 percent of your benefits if your income is 25000 to 34000 for an.

Those who are self. The 2022 limit for joint filers is 32000. Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits.

For Both 2021 And 2022 The Social Security Tax Rate For Employees And Employers Is 62 Of Employee Compensation For A Total Of 124. The employers Social Security payroll tax rate for 2021 January 1 through December 31 2021 is the same as the employees Social Security payroll tax. The IRS reminds taxpayers receiving Social Security benefits that they may have to pay federal income tax on a portion of those benefits.

Maximum earnings subject to Social Security taxes 2021 in dollars Program Amount. WEP 1st Applied in 2021. Social Security taxes in 2022 are 62 percent of gross wages up to 147000.

Ad The Portion of Your Benefits Subject to Taxation Varies With Income Level.

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Social Security What Is The Wage Base For 2023 Gobankingrates

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

:max_bytes(150000):strip_icc()/GettyImages-184127461-e960f1b3d8964e9ca317e4640e208ab2.jpg)

How Social Security Works For The Self Employed

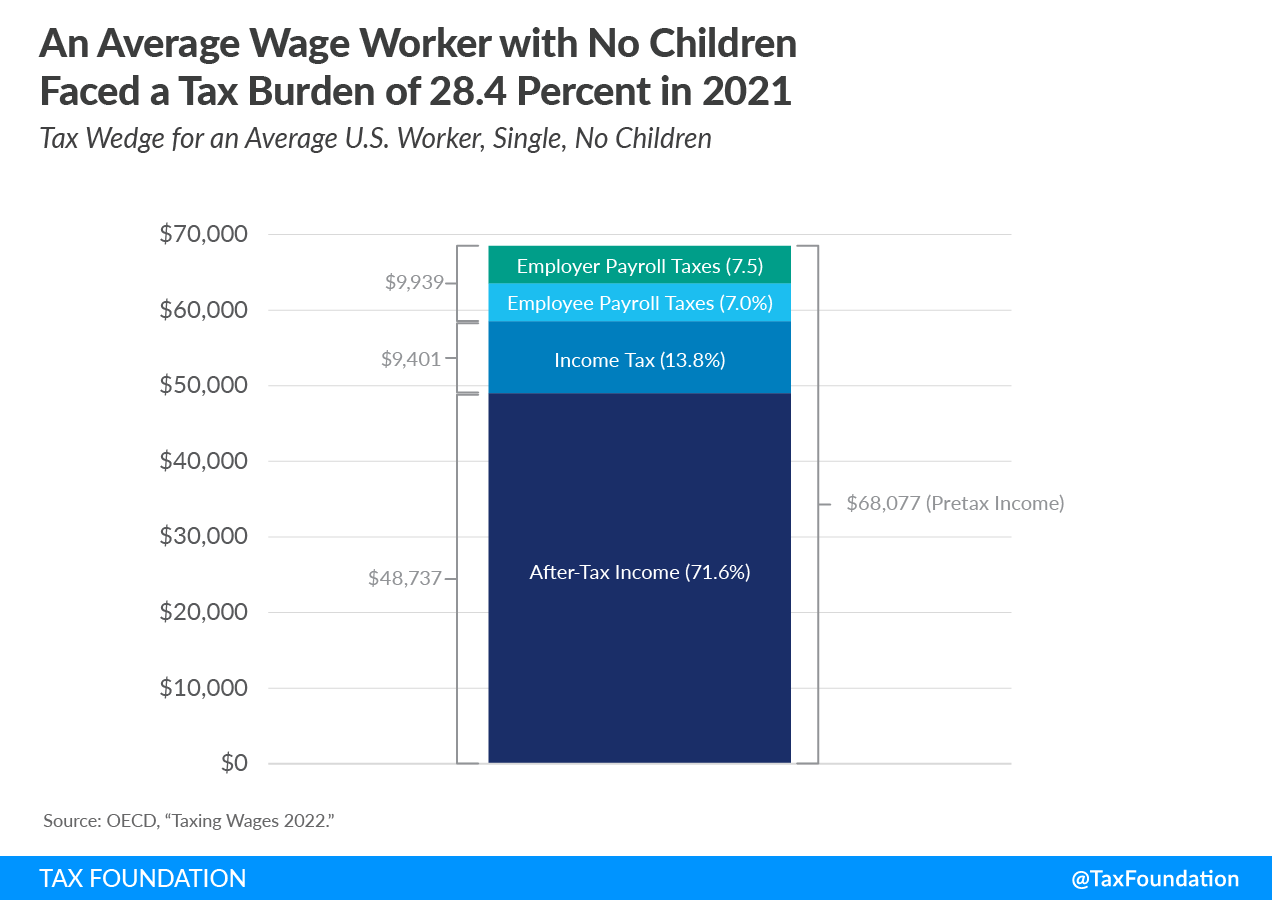

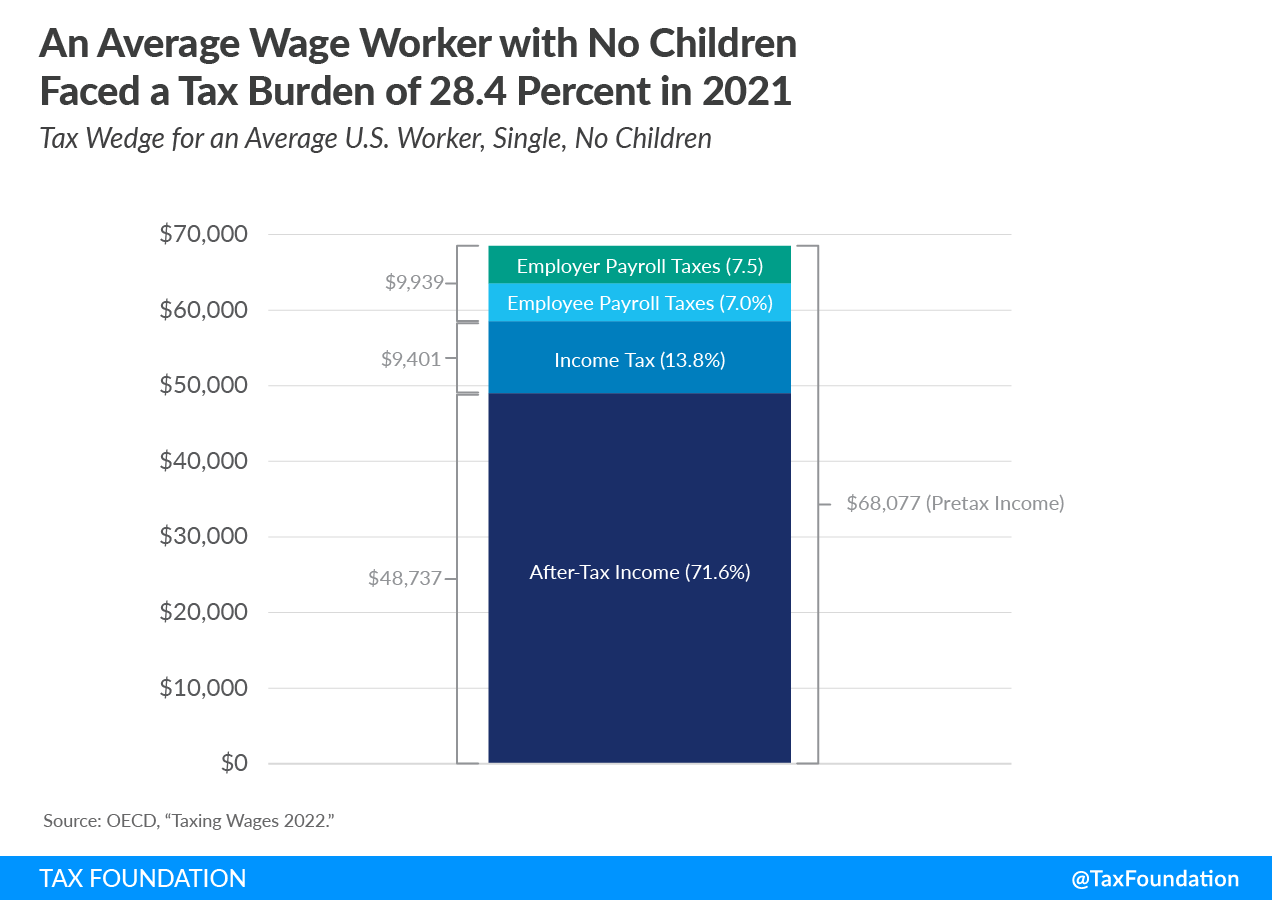

Tax Wedge Taxing Wages Details Analysis Tax Foundation

When To Collect Social Security Why You Should Wait The New York Times

2022 Wage Cap Jumps To 147 000 For Social Security Payroll Taxes

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Social Security Wage Base Increases To 142 800 For 2021

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

/heroexportjourney-4229705-df42b41ba8f7483fba08a542a4eae4ac.jpg)

Social Security Tax Definition

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

At What Age Is Social Security No Longer Taxed In The Us As Usa

/GettyImages-1134937342-4f983d6e2462466b902206a0525d82b3.jpg)

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)