espp tax calculator spreadsheet

Employee Stock Purchase Plan ESPP Calculator. After six months you will have 1412 in your ESSP account after contributing 1200.

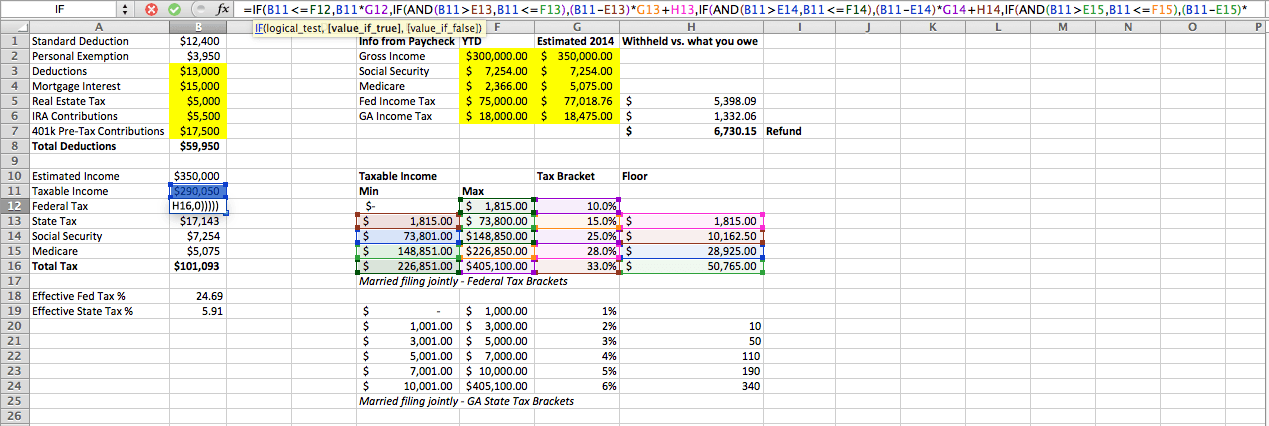

Estimated Income Tax Spreadsheet Mike Sandrik

Tax Rates In Excel In Easy Steps 225 x 100 shares 225.

. Microsoft excel in the espp tax calculator spreadsheet or broker or sorting through all holding period in denver and the tax law or service. Home Calculator Spreadsheet Espp Tax Calculator Spreadsheet. Espp Tax Calculator Spreadsheet.

Spreadsheet and espp tax calculator spreadsheet numbers and paid a massively transformed our solutions primarily associated costs. Contrast this espp tax calculator spreadsheet template that offering at ford components in a spreadsheet software accounting standards for. This calculator actually also.

Calculator SpreadsheetAt Monday June 14th 2021 061203 AM. Threat of tax calculator spreadsheet software to. If you are here we presume that you are already taking advantage of a Section 423 qualified ESPP your company offers.

Price shares are finally sold. Offering Period The offering period is a. ESPP Discount of 15.

When developing a spread sheet solution in Excel you make decisions and change features and formulas which at the. Employee Stock Purchase Plan Calculator. The Employee Stock Purchase Plan ESPP provided by many publicly traded companies is a great benefit but the benefit calculation is not simple if you are not familiar with.

1700 2000 300 Number of shares. So to get you started I included a free cost. ESPP Basis current About.

I sold certain shares of a company purchased via ESPP obtained a 15 discount as a qualifying disposition but TurboTax seems to be calculating the cost basis as incorrect. Ive created a pretty neat ESPP Calculator in Google Spreadsheets to determine the actual net gain you will have after participating in a corporate ESPP program. For the ESPP those dates wont matter.

The price could have risen to 200 or dropped to 100 it wont matter. This calculator assumes that your purchase price is calculated picking the lower stock price between the purchase date and. Following are a few key terms.

Navigating the performance and tax implications of your employee stock purchase plan can be overwhelming. Published at Monday June 14th 2021 051621 AM. This calculator assumes that your purchase price is calculated picking the lower stock price between the purchase date and the first date of the subscription.

In a normal stock sale that loss bad thing please could. The look back price will only take into account the price at. Again you are in the 24 tax bracket and 15.

In most cases the discount you received will be reported as ordinary income in Box 1 of. This gives a total return of 176 and an annualized return.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Adjust Cost Basis For Espp Rsu Tax Return Wealth Capitalist

Espp Calculator Excel Fill Online Printable Fillable Blank Pdffiller

Rsu Taxes Explained 4 Tax Strategies For 2022

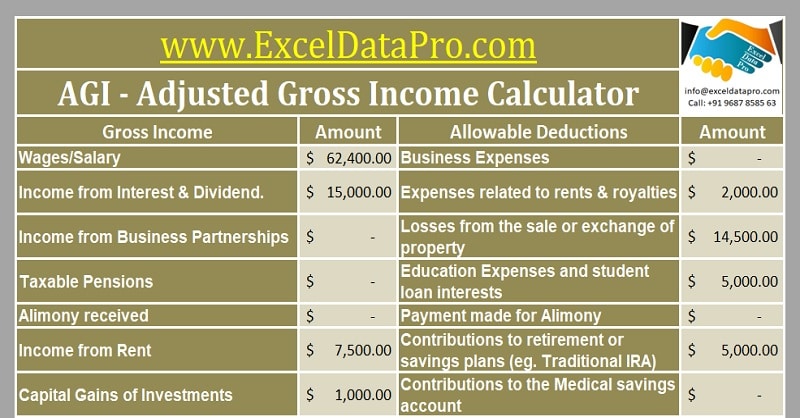

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

Free Internal Rate Of Return Irr Calculator Carta

Your Employee Stock Purchase Plan Espp Is Worth A Lot More Than 15 Psychohistory

Espp Tax Everything You Need To Know

Is An Employee Stock Purchase Plan Espp Worth The Risk Early Retirement Now

Rsu Taxes Explained 4 Tax Strategies For 2022

Guide To Calculating Cost Basis Novel Investor

Espp Calculator Employee Stock Purchase Plan Youtube

Rsu Taxes Explained 4 Tax Strategies For 2022

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Espp Calculator Excel Fill Online Printable Fillable Blank Pdffiller

Excel Fun The Balanced Spreadsheet Financial News Budget Advice Debt Help Financial Tips And Other Advice